Table of Contents

Accounting Periods In Navision

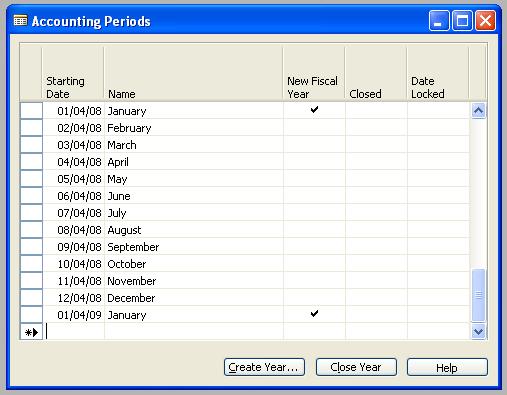

The Accounting Periods window used to open new fiscal years, define accounting periods and close fiscal years. The shortest possible accounting period is one day. You must set up at least one accounting period for each fiscal year.

The window contains a line for each accounting period. You can open the Accounting Periods window from Financial Management — Setup — Accounting Periods. Following pictures shows the accounting period window.

|

| Accounting Period |

How to Opening a New Fiscal Year In Navision?

To open a new Fiscal Year you have to follow following 5 steps.

|

| Accounting Period Creation Page |

- Open the Accounting Periods window( Financial Management –> Setup–> Accounting Periods).

- Click Create Year.

- On the Options tab, define the structure of the fiscal year. The fiscal year is normally 12 periods of one month each, but you can also divide it in other ways.

- Fill in the fields. For Help about a specific field, click the field and click F1.

- Click OK.

The program creates the accounting periods and shows the result. It fills in the Starting Date field and fills in the Name field with the name of the month from the starting date.

After the last period in the fiscal year, the program inserts an accounting period with a check mark in the New Fiscal Year field.

After the last period in the fiscal year, the program inserts an accounting period with a check mark in the New Fiscal Year field.

Closing Accounting Periods

How to Close Accounting Periods(Financial Year) In Navision?

To close the accounting periods in the Microsoft Dynamics NAV(Navision) you have to follow following steps:

-

Open the Accounting Periods window(Financial Management –> Setup–> Accounting Periods).

-

Click Close Year. If more than one fiscal year is open, the program assumes that the earliest one should be closed. It displays a message identifying the year it will close and explains the consequences of closing it.

-

To close the year, click Yes.

Now the fiscal year is closed, and the program places a check mark in the Closed and Date Locked fields for all the periods in the year. Now the fiscal year cannot be opened again and you cannot remove the check mark from the Closed or Date Locked fields.

Following are the important points you have to note when you are doing the Close Financial Year In Navision

-

You cannot close a fiscal year before you create a new one. Notice that when a fiscal year has been closed, you cannot change the starting date of the following fiscal year.

-

Even though a fiscal year has been closed, you can still post G/L entries to it. When you do this, the entries will be marked as posted to a closed fiscal year – the Prior-Year Entry field will contain a check mark.

-

After a fiscal year is closed, you must close the income statement accounts and transfer the year’s results to an account in the balance sheet. And you can repeat it each time you post to the closed fiscal year.