The Chart of Accounts (COA) is a fundamental component in financial management systems like Business Central and NAV (Navision). This guide will explain what a COA is, why it’s important, how it’s structured, and how it simplifies financial transactions.

Table of Contents

What is Chart of accounts(COA)?

The Chart of Accounts (COA) is a structured list of all accounts used by an organization. It can be organized numerically, alphabetically, or using a combination of both. Each account in the COA is unique, making it easy to locate and manage. Typically, the list is arranged in the order of financial statements, with profit and loss accounts first, followed by balance sheet accounts.

Read More: Finance Module in Dynamics 365 NAV / Business Central

Basic Structure of a Chart of Accounts

The COA is divided into several categories, each representing a key area of financial activity.

Assets: Accounts that track everything the business owns (e.g., Cash, Accounts Receivable, Inventory).

Liabilities: Accounts for what the business owes (e.g., Loans, Accounts Payable).

Equity: Accounts that represent the owner’s stake in the company (e.g., Capital, Retained Earnings).

Revenue: Accounts where income is recorded (e.g., Sales, Service Revenue).

Expenses: Accounts for all costs incurred by the business (e.g., Rent, Utilities, Salaries).

Recommended Chart of Accounts Numbering System

Sample recommended GL Account Numbering System as follows

Assets (1000-1999)

Example:

- 1010 – Cash

- 1100 – Accounts Receivable

- 1200 – Inventory

Liabilities (2000-2999)

Example:

- 2010 – Accounts Payable

- 2100 – Long-Term Loans

Equity (3000-3999)

Example:

- 3010 – Owner’s Equity

- 3100 – Retained Earnings

Revenue (4000-4999)

Example:

- 4010 – Product Sales

- 4100 – Service Revenue

Expenses (5000-5999)

Example:

- 5010 – Rent Expense

- 5100 – Salaries Expense

Best Practices for Setting Up a Chart of Accounts (COA)

Consistency in Numbering and Naming : Use a logical and consistent system for numbering and naming accounts to ensure the COA is easy to navigate.

Use of Sub-Accounts : Sub-accounts provide more detail without cluttering the main COA. For example, under ‘Utilities Expense’ (e.g., 5300), you might have sub-accounts for electricity, water, and internet.

Simplify with Dimensions : Instead of creating many accounts, use dimensions to categorize transactions by department, project, or location.

Industry-Specific Recommendations

This is another important points needs to considering while preparing any chart of account. You should mention Industry specific accounts related to the Implementation you are performing.

Retail

Include specific accounts for different types of inventory (e.g., Raw Materials, Finished Goods).

Manufacturing

Add accounts for Work-in-Progress and Cost of Goods Sold (COGS).

Service-Based Businesses

Use detailed revenue accounts to differentiate between service types.

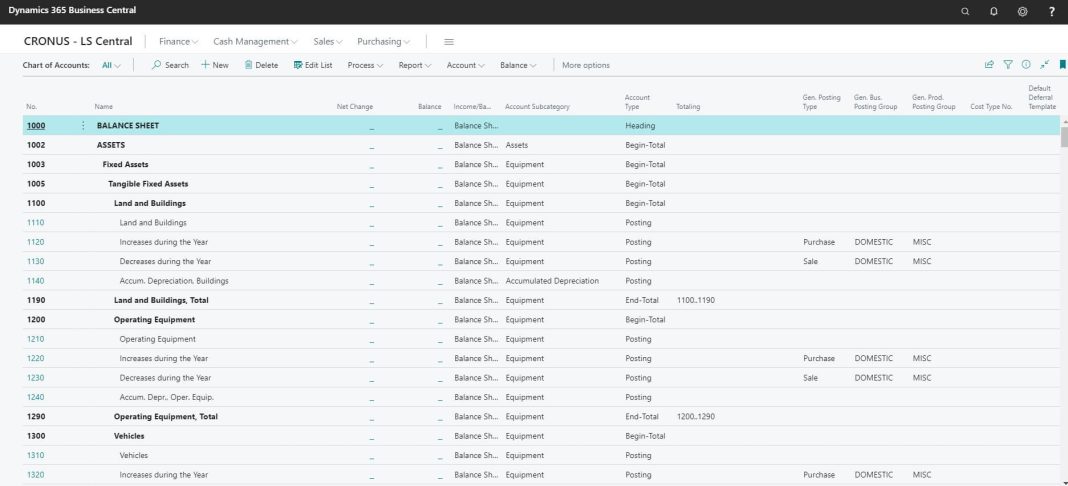

Business Central Chart of Account : Important Fields

- No : Specifies the number of the involved entry or record, according to the specified number series. In other words this is the G/L account no.

- Name : Specifies the name of the general ledger account.

- Income/Balance : Specifies whether a general ledger account is an income statement account or a balance sheet account.

- Account Subcategory: Specifies the subcategory of the account category of the G/L account. Here you may specify Assets, accounts Receivable, inventory, etc. for easy identification of Income / Expense belongs to.

- Account Type : This is one of the important field which specifies the purpose of the account.

- Total: Used to total a series of balances on accounts from many different account groupings. To use Total, leave this field blank.

- Begin-Total: A marker for the beginning of a series of accounts to be totaled that ends with an End-Total account.

- End-Total: A total of a series of accounts that starts with the preceding Begin-Total account. The total is defined in the Totaling field.

- Totaling : Specifies an account interval or a list of account numbers. The entries of the account will be totaled to give a total balance. How entries are totaled depends on the value in the Account Type field.

Simple Chart of Accounts Group Headings:

- Asset Accounts: From cash and accounts receivable to buildings and vehicles, these represent the economic resources owned by the business.

- Liability Accounts: Accounts payable and notes payable (both current and long-term) are part of this category, representing the business’s economic obligations.

- Stockholders’ Equity Accounts: Including common stock, retained earnings, and income statement accounts, this category reflects the residual equity of the business.

- Revenue Accounts: Sales revenue, returns and allowances, discounts, and interest income fall under this category, showcasing the company’s gross earnings.

- Expense Accounts: Advertising, bank fees, depreciation, payroll, and various other expenses necessary for operation are neatly categorized.

Types of Accounts and Contra-Accounts:

Understanding the types of accounts – asset, liability, equity, revenue, and expense – is crucial. Additionally, contra-accounts, such as Accumulated Depreciation, represent deductions to relatively permanent assets like buildings.

Trial Balance:

While a balanced trial balance is essential, it doesn’t guarantee the absence of errors. This listing of active general ledger accounts is a critical step in financial management.

Chart of Accounts Window / Card Page:

At the heart of a company’s financial structure lies the Chart of Accounts window. This is the central hub where all general ledger entries are posted and managed. Whether creating new accounts here or in the G/L Account Card window, the process remains consistent.

For easy reference, here’s a listing of the important headings available on the COA list.

- Sales

- Cost of Sales

- Direct Expenses

- Administration Expenses

- Selling Expenses

- Distribution Expenses

- Establishment Expenses

- Financial Expenses

Within each of these headings will be the individual nominal ledger accounts that make up the chart of accounts. Establishment expenses may consist of rent, rates, repairs, and other balance sheet accounts.

Asset Accounts:

- Cash

- Accounts Receivable

- Prepaid Expenses

- Supplies

- Inventory

- Land

- Buildings

- Vehicles & Equipment

- Accumulated Depreciation

- Other Assets

Liability Accounts:

- Accounts Payable

- Notes Payable – Current

- Notes Payable – Long Term

Stockholders’ Equity Accounts:

- Common Stock

- Retained Earnings

- Income Statement Accounts

Revenue Accounts:

- Sales Revenue

- Sales Returns & Allowances

- Sales Discounts

- Interest Income

Expense Accounts

- Advertising Expense

- Bank Fees

- Depreciation Expense

- Payroll Expense

- Payroll Tax Expense

- Rent Expense

- Income Tax Expense

- Telephone Expense

- Utilities Expense

Chart of Account ( COA ) : FAQ

Its a listing of all the financial accounts in your general ledger, categorized by type. In other words, It’s a structured list of all accounts used for managing a company’s finances in Microsoft Dynamics 365 Business Central.

Yes, Business Central allows full customization to fit your specific business needs.

Numbering ensures accounts are logically organized and easily searchable.

Conclusion:

The Chart of Accounts is more than just a list; it’s a dynamic tool that empowers organizations to manage and navigate their financial landscape effectively. Whether you’re using Business Central or NAV, understanding and optimizing your COA is crucial for achieving financial clarity and success.