Table of Contents

Goods and Service Tax ( GST )

What is GST?

Goods and Service Tax (GST) is an indirect tax levied on supply of goods or services or both.

- It is a destination / consumption based tax levy which is payable in the state in which the goods and services are consumed.

- It is levied and collected on value addition at each stage of production or distribution process (all points in supply chain).

- The supplier can avail credit on input tax credit paid on procurement of goods or services.

- It extends to the whole of India except Jammu and Kashmir.

After GST no more double taxation effect of indirect taxes.

If you are already aware about GST Introduction then go to the following links for further details

List of Dynamics NAV Version with direct GST Hot fix ( Updates ) available?

- Microsoft Dynamics NAV 2013

- Microsoft Dynamics NAV 2013 R2

- Microsoft Dynamics NAV 2016

GST Quick and Easy Video

Please check following video for quick GST reference

GST Implementation Date ?

As per latest information GST will implement on July 01 2017

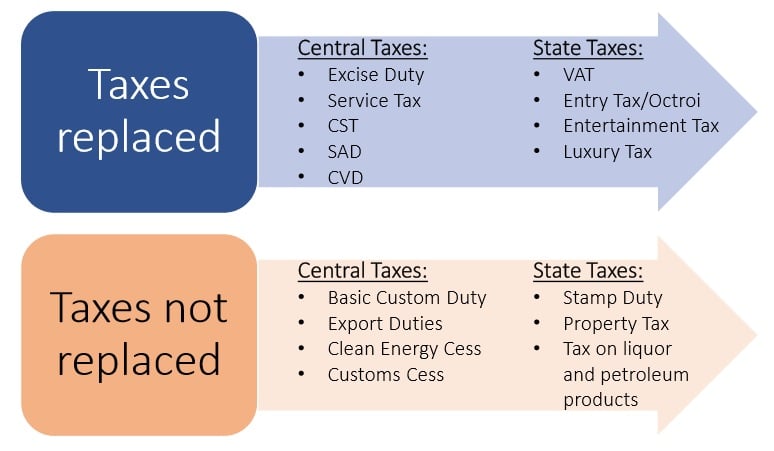

Taxes Replaced and Not Replaced list

Replaced Taxes details are as follows

- Excise Duty

- Service Tax

- CST

- SAD

- CVD

- VAT

- Entry Tax / Octroi

- Entertainment Tax

- Octroi

Taxes not replaced and continuing are as follows

- Basic Custom Duty

- Export Duties

- Clean Energy Cess

- Custom Cess

- Stamp Duty

- Property Tax

- Tax on Liquor and Petroleum Products

GST Tax Effects

Before GST

Following image shows the present architecture of Indian Tax.

After GST

Following image like tax Structures will effect after GST Implementation.

GST Components

GST Components are categorized under following formats

Sales Of Goods within State

If you are selling the goods within same state then will attract following taxes

- SGST

- CGST

Sales Of Goods within Union Territory

If you are selling the goods within union territory then will attract following taxes

- UTGST

- CGST

Sales Of Goods between 2 States

If you are selling the goods between different state then will attract following taxes

- IGST

GST Registration

Every person required to take registration in every state of supply if your turnover is above the 20 Lakhs.

GST Registration Number

Registration Number under GST is called Goods and Service Tax Payer Identification Number (GSTIN). It is a state-wise PAN based 15-digit number the structure of which is as follows

- First 2 Digit – State Code

- 3 to 12 digits mentioning PAN Number

- 13th Digit is Entity Code

- 14th Digit is Check Digit

- 15th digit is Blank

What will be the tax rate after GST Implementation?

- Four tax rates namely 5%, 12%, 18% and 28%

- Some goods and services would be exempt

- Separate tax rate for precious metals

- Cess over the peak rate of 28% on specified luxury and sin Goods

Main Features of the GST in India

- GST to be levied on supply of goods or services

- All transactions and processes only through

- Electronic mode – Non-intrusive administration

- PAN Based Registration

- Registration only if turnover more than Rs. 20 lac

- Option of Voluntary Registration

- Deemed Registration in three days

- Input Tax Credit available on taxes paid on all procurement s (except few specified items)

- Credit available to recipient only if invoice is matched – Helps fight huge evasion of taxes

- Set of auto-populated Monthly returns and Annual Return

- Composition taxpayers to file Quarterly returns

- Automatic generation of returns

- Separate electronic ledgers for cash and credit

- Tax can be deposited by internet banking, NEFT / RTGS,

- Debit/ credit card and over the counter

- Cross utilization of IGST Credit first as IGST and then as

- CGST or SGST /UTGST

- Concept of TDS for Government Departments

- Concept of TCS for E-Commerce Companies

- Refund to be granted within 60 days

- Provisional release of 90% refund to exporters within 7 days

- Interest payable if refund not sanctioned in time

- Refund to be directly credited to bank accounts

- Comprehensive transitional provisions for smooth transition of existing tax payers to GST regime

- Special procedures for job work

- System of GST Compliance Rating

- Anti-Profiteering provision

Benefits of GST

- Overall reduction in Prices for Consumers

- Reduction in Multiplicity of Taxes, Cascading and Double Taxation

- Uniform Rate of Tax and Common National Market

- Broader Tax Base and decrease in “Black” transactions

- Free Flow of Goods and Services – No Checkpoints

- 6 Non-Intrusive Electronic Tax Compliance System

** Keep on visit this place for latest updates of GST releases.